Dubai Real Estate: Turning Ambition Into Smart Investment

Dubai is more than a city of striking architecture and luxury lifestyles—it is a place where disciplined investors have the tools to build wealth with transparency and security. While its skyline often dominates magazine covers, the real engine of Dubai’s property success is its strong legal framework, forward-thinking infrastructure, and investor-friendly policies.

Dubai is more than a city of striking architecture and luxury lifestylesit is a place where disciplined investors have the tools to build wealth with transparency and security. While its skyline often dominates magazine covers, the real engine of Dubais property success is its strong legal framework, forward-thinking infrastructure, and investor-friendly policies.

But while opportunity is abundant, its also accompanied by complexity. Savvy investors know that the right strategy, timing, and professional guidance make the difference between a promising acquisition and a costly misstep.

What Sets Dubai Apart in the Global Property Market

A combination of fundamentals positions Dubai as a top choice for both institutional and individual investors:

-

Zero Annual Property Taxes

With no income or capital gains taxes on property, investors keep more of their returns compared to many mature markets. -

Transparent Ownership Laws

The Dubai Land Department (DLD) and Real Estate Regulatory Agency (RERA) ensure clear procedures and enforceable protections for buyers. -

Residency Incentives

Real estate investments above certain thresholds qualify for long-term visas, making Dubai attractive for relocation and business setup. -

Stable Demand

A growing population of professionals and entrepreneurs sustains consistent rental demand across all price brackets. -

Future-Ready Infrastructure

Continuous investment in transportation, healthcare, and smart city initiatives strengthens Dubais long-term value proposition.

These elements arent temporary advantagesthey are core pillars that have helped the market mature over decades.

Set Your Goals Before You Start

Before you explore neighborhoods or compare payment plans, define your purpose. Consider:

-

Are you seeking steady rental income or capital appreciation?

-

Will you hold the property for the short term (13 years) or long term (510 years)?

-

Is this investment purely financial, or will you also use the property yourself?

These questions shape every aspect of your search, from property type to financing strategy.

Understanding Ready vs. Off-Plan Properties

Dubais market offers two main pathways:

Ready Properties

-

Available for immediate occupation or rental

-

Offer transparent pricing based on current market conditions

-

Allow faster title transfer and potential resale

Off-Plan Properties

-

Usually priced lower per square foot

-

Feature flexible payment structures staggered over construction

-

Carry potential for price appreciation as the project progresses

Both strategies have merit, depending on your goals and risk appetite.

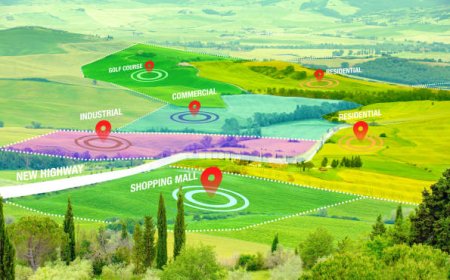

Communities With Strong Potential

Location in Dubai can be the difference between steady returns and slower growth. Here are examples of proven and emerging areas:

Established Hotspots

-

Downtown Dubai High-profile towers with robust demand and premium rents

-

Dubai Marina Waterfront living appealing to professionals and families

-

Business Bay Mixed-use district near DIFC and Downtown

Emerging Growth Zones

-

Dubai Creek Harbour Large-scale master plan with ambitious infrastructure

-

Meydan Rapidly developing with new lifestyle communities

-

Dubai South Expanding residential and logistics hub near Al Maktoum Airport

Researching each communitys history and future plans helps you make informed choices.

The Legal Framework: What You Need to Know

Dubais real estate system is built for clarity and protection. Key points include:

-

Freehold Ownership

Foreign investors can fully own property in designated zones. -

DLD Registration Fee

A 4% fee applies to the purchase price at registration. -

Escrow Accounts

Off-plan payments are deposited into government-regulated accounts released as construction milestones are met. -

Oqood Certificate

Interim proof of ownership for off-plan investments. -

Title Deed

Issued upon project handover to establish full legal ownership.

Knowing these steps avoids surprises during the transaction.

Why Professional Guidance Matters

Even in a transparent market, specialized knowledge can uncover opportunities and reduce risk. Working with an experienced real estate agent Dubai delivers:

-

Access to pre-launch and off-market properties

-

Comparisons of developer reputation and past performance

-

Data-driven rental yield and appreciation projections

-

Negotiation support for favorable terms and payment plans

-

Help coordinating legal documentation and escrow arrangements

These insights can be the difference between a good investment and a great one.

Managing Your Property for Consistent Returns

Long-term success depends on effective property management:

-

Professional marketing and tenant sourcing

-

Lease negotiation and renewals

-

Rent collection and financial reporting

-

Maintenance and compliance management

-

Licensing for short-term rentals if desired

Especially for overseas investors, professional management safeguards your asset and income stream.

Conclusion: Preparation Makes Opportunity Real

Dubai rewards investors who combine vision with discipline. Its tax advantages, legal protections, and steady demand create fertile ground for building wealthbut only when you approach the market with a clear plan.

Define your objectives, learn the regulations, and collaborate with experienced professionals. With preparation and focus, your investment can become a cornerstone of long-term financial success in one of the worlds most dynamic cities.