Why Vertical SaaS Is Taking Over Fintech (And Who’s Winning)

Discover how vertical SaaS in fintech is driving innovation and efficiency in niche financial sectors. Learn who’s leading and why it matters.

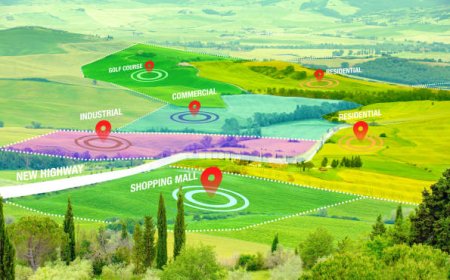

The evolution of SaaS fintech is entering a new phase, where specialization beats scale. In 2025, vertical SaaS in fintech is gaining dominance by focusing on specific industrieslike healthcare, legal, or real estateand solving highly tailored financial challenges. This shift toward niche-focused platforms is transforming how financial services are built, sold, and scaled.

What Is Vertical SaaS in Fintech?

Vertical SaaS in fintech refers to cloud-based financial software built for a specific industry. Unlike horizontal solutions that serve multiple sectors, vertical fintech SaaS platforms are designed around the workflows, regulations, and needs of a particular market.

For example, instead of using a general invoicing system, a healthcare clinic might opt for a platform that combines medical billing with SaaS for healthcare finance features like patient financing, compliance reporting, and insurance claims.

This industry-specific model is quickly outpacing general solutions thanks to its ability to provide deeper value and faster results.

Why Vertical SaaS Is Taking Over Fintech

Here are some key reasons why vertical SaaS in fintech is becoming the go-to model in 2025:

-

Industry-Specific Compliance: Healthcare, legal, and education have strict regulations. Vertical solutions come ready to support HIPAA, GLBA, and other frameworks.

-

Faster Time-to-Value: Tailored software requires less customization, leading to quicker onboarding and adoption.

-

Deeper User Understanding: Platforms are built around the daily tasks and challenges of specific users, increasing satisfaction and retention.

-

Higher Margins: Niche providers can charge premium prices due to specialization and lower churn rates.

-

Ecosystem Integrations: These tools often integrate with vertical-specific systems like EHR (Electronic Health Records) or real estate MLS systems.

Real-World Examples of Vertical SaaS in Fintech

1. Panacea Financial SaaS for Healthcare Finance

Designed for doctors and medical professionals, Panacea offers banking services, student loan refinancing, and practice loans tailored to the healthcare industry.

2. Baselane Real Estate Finance

This platform helps landlords manage rent collection, property finances, and accounting in one placea prime example of niche fintech software solutions.

3. LawPay Legal Financial Management

Built specifically for law firms, LawPay enables compliant trust accounting and integrates with legal practice management tools.

4. Aplos Nonprofit Financial Software

A SaaS platform offering fund accounting, donation tracking, and grant management tailored for nonprofit organizations.

Each of these products showcases how vertical SaaS in fintech can outperform broad platforms by addressing unique industry needs.

The Role of SaaS Development Services

While vertical SaaS products offer out-of-the-box value, many businesses still require customization or integration with existing tools. This is where experienced SaaS development services become essential. These services help organizations modify fintech platforms to suit their operational workflows, security requirements, and regional compliance needs.

By working with specialists, companies can launch faster and ensure their solution fits both the market and the internal team structure.

Whos Winning the Vertical SaaS Fintech Race?

The winners in this space are platforms that:

-

Focus on underserved or highly regulated industries

-

Embed financial tools like lending, insurance, and billing directly into workflows

-

Offer a seamless user experience for both professionals and end customers

-

Scale through API-based integrations and embedded finance partnerships

Whether it's a dentist getting instant business credit or a landlord managing tenant payments with a few clicks, vertical SaaS in fintech is creating hyper-personalized experiences that general SaaS simply can't match.

Conclusion

In 2025, vertical SaaS in fintech is not just a rising trendits a proven growth strategy for financial software providers. As industries demand tailored solutions, platforms that understand their niche will continue to outperform broad-based competitors.

By combining deep domain knowledge with modern cloud infrastructure, these solutions are defining the next era of SaaS fintech. To succeed in this space, businesses must look beyond horizontal scalability and focus on building or partnering with niche fintech software solutions that deliver specialized value.

With the support of expert SaaS development services, companies can ensure their platforms are future-ready, compliant, and fully aligned with user needs. The future of fintech is verticaland its already here.